Neighborhood Housing Services Website

Call Linda Rowe at 405-231-4663

email Linda Rowe at lindar@nhsokla.org

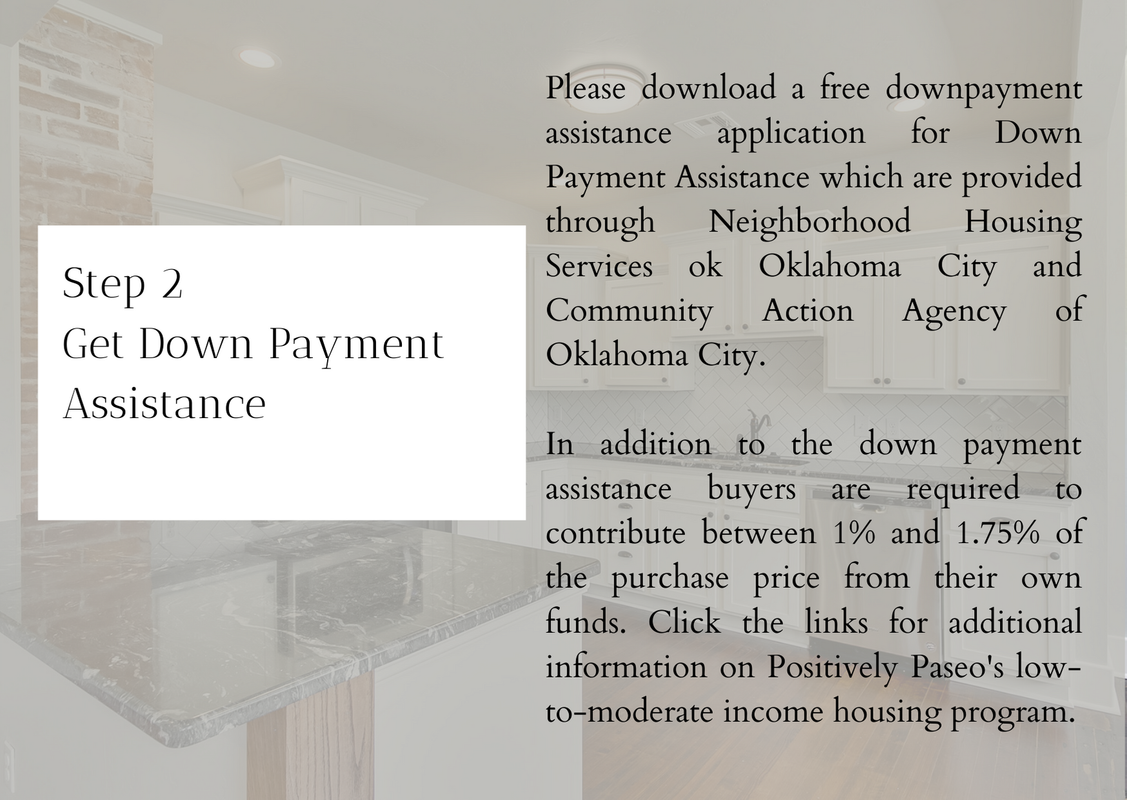

![]() Download the NHS Downpayment Assistance Application

Download the NHS Downpayment Assistance Application

Community Action Agency of Oklahoma City Website

Call Alejandra Martinez at 405-232-0199

Email Alejandra Martinez at hcounselor@caaofokc.org

![]() Download the CAA Downpayment Assistance Application

Download the CAA Downpayment Assistance Application

Lender/Realtor DPA Program DPA Program Guidelines